Are you finding it hard to juggle multiple crypto wallets?

You are not alone. As DeFi grows, keeping them organized and error-free is becoming more complex. Another spreadsheet is not the answer. You need multi-wallet connectivity, seamless crypto wallet integration, and secure wallet connections that keep assets safe while remaining actionable.

CROPR brings all these capabilities together in one secure, unified platform.

In this guide, you’ll discover how CROPR helps you manage multiple wallets securely, simplify daily operations, and unlock more opportunities across chains.

Why Multi-Wallet Management Matters

Without a unified approach, managing multiple wallets becomes fragmented and time-consuming. Users end up constantly switching between different interfaces, manually checking balances across wallets, and visiting various DeFi platforms just to understand their complete portfolio position. This process often leads to missed opportunities, overlooked rewards, and difficulty making informed decisions about overall portfolio strategy.

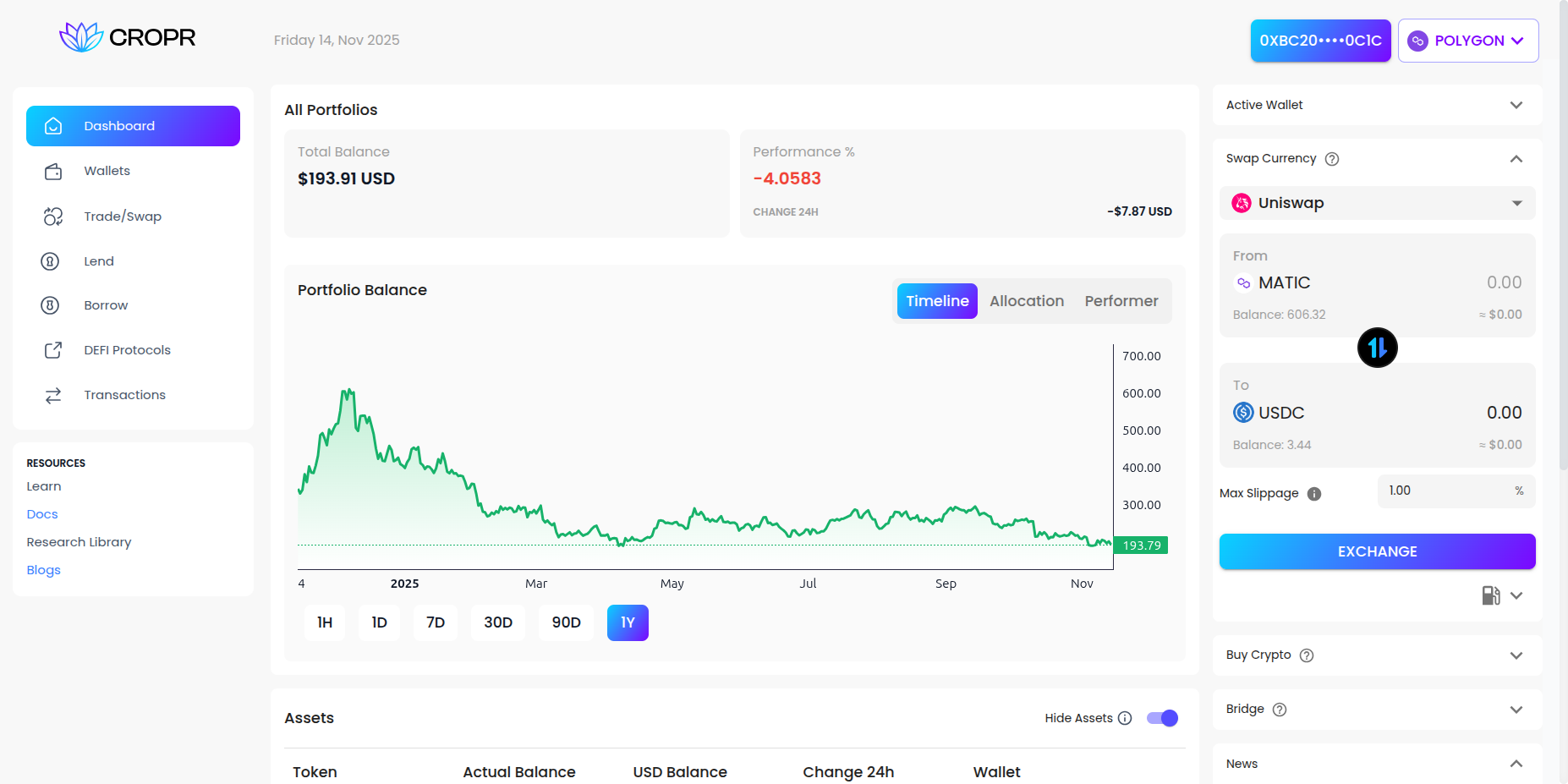

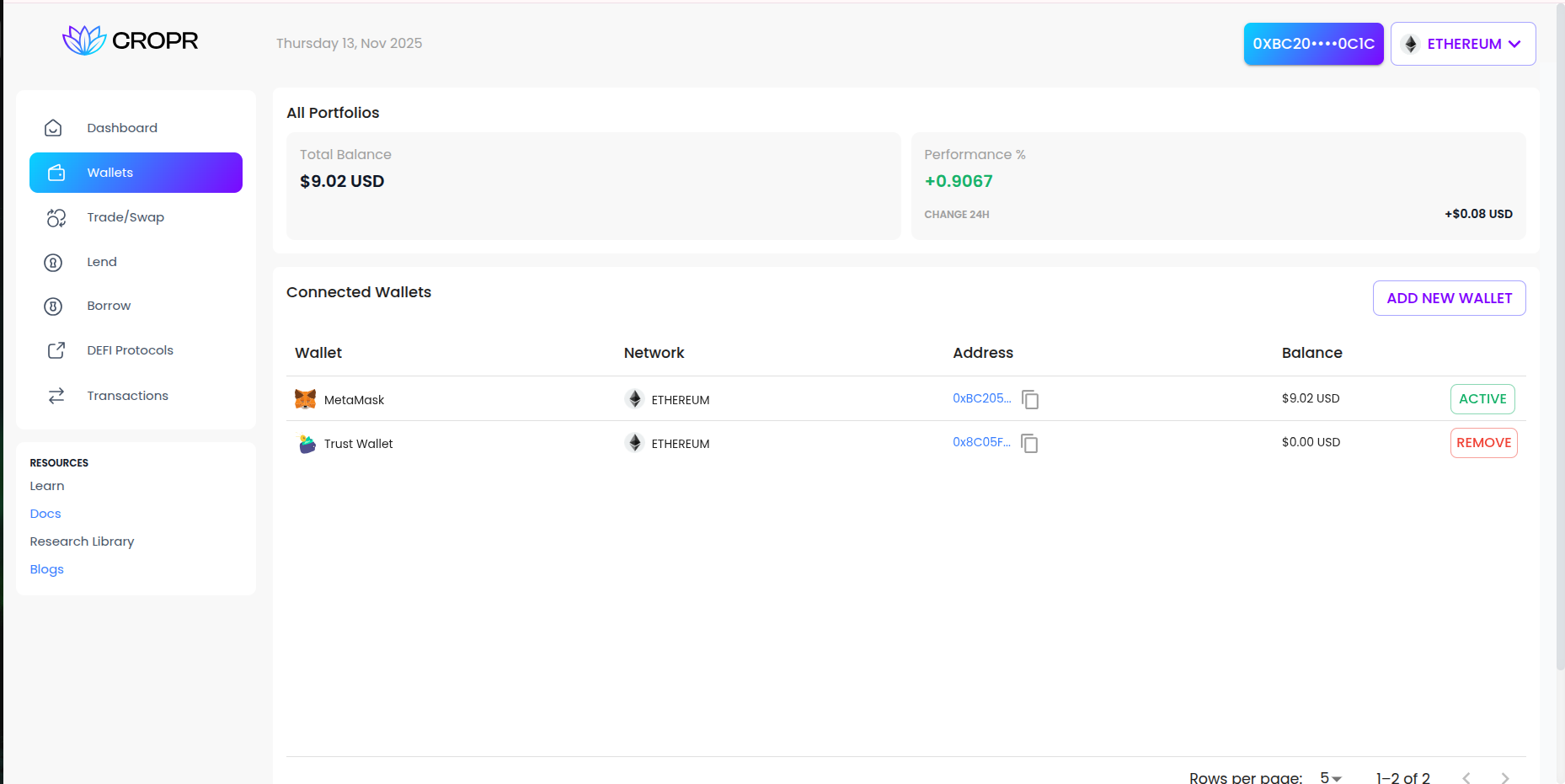

With CROPR, this process becomes organized and efficient. The platform connects multiple wallets without requiring users to move funds or compromise their existing security setup. CROPR’s single dashboard provides real-time insights across chains and protocols, making it significantly easier to monitor performance, track rewards, and spot opportunities without the extra steps of navigating between different applications and platforms.

How CROPR Simplifies Multi-Wallet Management

CROPR offers secure multi-wallet connect, integrated DeFi operations, and real-time portfolio insights, all in one platform.

Here’s how our platform handles the key requirements:

- Unified Dashboard: Link multiple wallets and view balances, protocol positions, and stakes across chains like Ethereum, Polygon, Base, Avalanche, BNB Chain, Arbitrum, Optimism, and Linea in a single portfolio view.

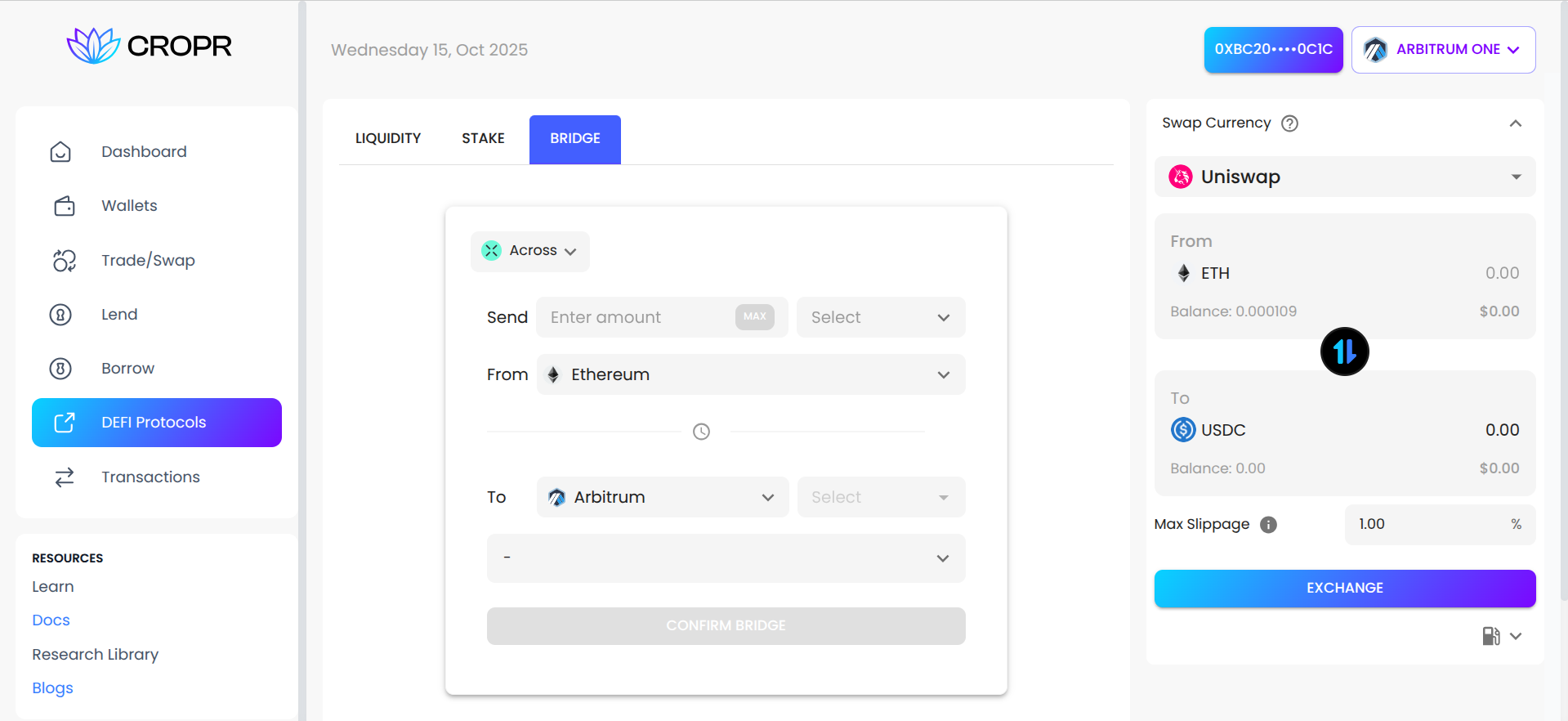

- Integrated DeFi Actions: Swap, lend, borrow, stake, or bridge without leaving CROPR, reducing friction and risk.

- Secure Wallet Connections: Private keys stay with you. CROPR requests only necessary permissions and uses standard secure wallet integration methods.

- Real-Time Monitoring and Alerts: Get instant updates on portfolio value, protocol yields, and bridging fees.

- Transparent Analytics: Track profits, fees, and returns across wallets to make informed decisions about when and where to move assets.

CROPR Multi-Wallet Platform in Action: DeFi Use Cases

CROPR fits diverse crypto strategies with secure wallet connections and powerful crypto portfolio management tools:

- Active DeFi Yield Seeker: You can manage wallets on Polygon, Arbitrum, and Base. Track yields, monitor fees, and move assets across chains or protocols without leaving CROPR.

- Long-Term Holder: You can monitor staking rewards and collateral health with real-time alerts for complete peace of mind.

- Portfolio and Tax Reporting: You can export historical data, aggregate transactions, and view cross-wallet PnL in one dashboard, eliminating manual reconciliation across chains.

Managing Core Risks: How CROPR Protects Your Assets

Even top multi-wallet crypto platforms face key risks. CROPR addresses them directly:

- Cross-Chain Operations: Moving assets between chains involves smart contract interactions. CROPR integrates with established cross-chain bridges to facilitate transfers across its supported networks including Ethereum, Polygon, Base, Avalanche, BNB Chain, Arbitrum, Optimism, and Linea.

- Data Accuracy: Portfolio tracking across multiple chains requires reliable data feeds. CROPR provides real-time insights across its supported protocols including Uniswap, Aave, Compound, and other integrated DeFi platforms.

- User Interface Clarity: Complex DeFi interactions can lead to user errors. CROPR simplifies portfolio management by consolidating multiple protocols into a single interface, reducing the complexity of navigating between different dApps and platforms.

Strategic Approach to Multi-Wallet Management

Effective multi-wallet management requires a structured security framework and appropriate management tools. Begin by establishing a clear wallet segregation strategy that defines specific purposes for each wallet configuration.

Once wallet allocation purposes are defined, maintain consistency in this structure. CROPR supports this security model while providing the necessary visibility and access capabilities for efficient portfolio management.

The platform is designed to eliminate the traditional trade-off between security and convenience, recognizing that the DeFi ecosystem has matured to support solutions that deliver both comprehensive security and operational efficiency.

Key Takeaways for Smarter Multi-Wallet Management

Remember, your goal is to manage multiple wallets and create a sustainable approach to DeFi that protects your assets while maximizing your opportunities. The fragmented nature of traditional wallet management doesn’t have to be your reality anymore.

With the right strategy and a tool like CROPR, a multi-wallet crypto platform designed for serious DeFi investors, multi-wallet management will shift from a daily headache to a competitive edge. Instead of spending hours switching platforms and checking balances, you’ll be identifying profitable opportunities and executing strategic moves.