Every crypto investor wants higher returns, yet most lose them to complexity: too many chains, too many dashboards, and too little time.

Opportunities exist across staking, liquidity pools, lending, yield farming, and cross-chain strategies. Yet, the challenge lies in managing scattered portfolios and constant switching between platforms.

That’s where returns disappear. And that’s exactly what CROPR fixes.

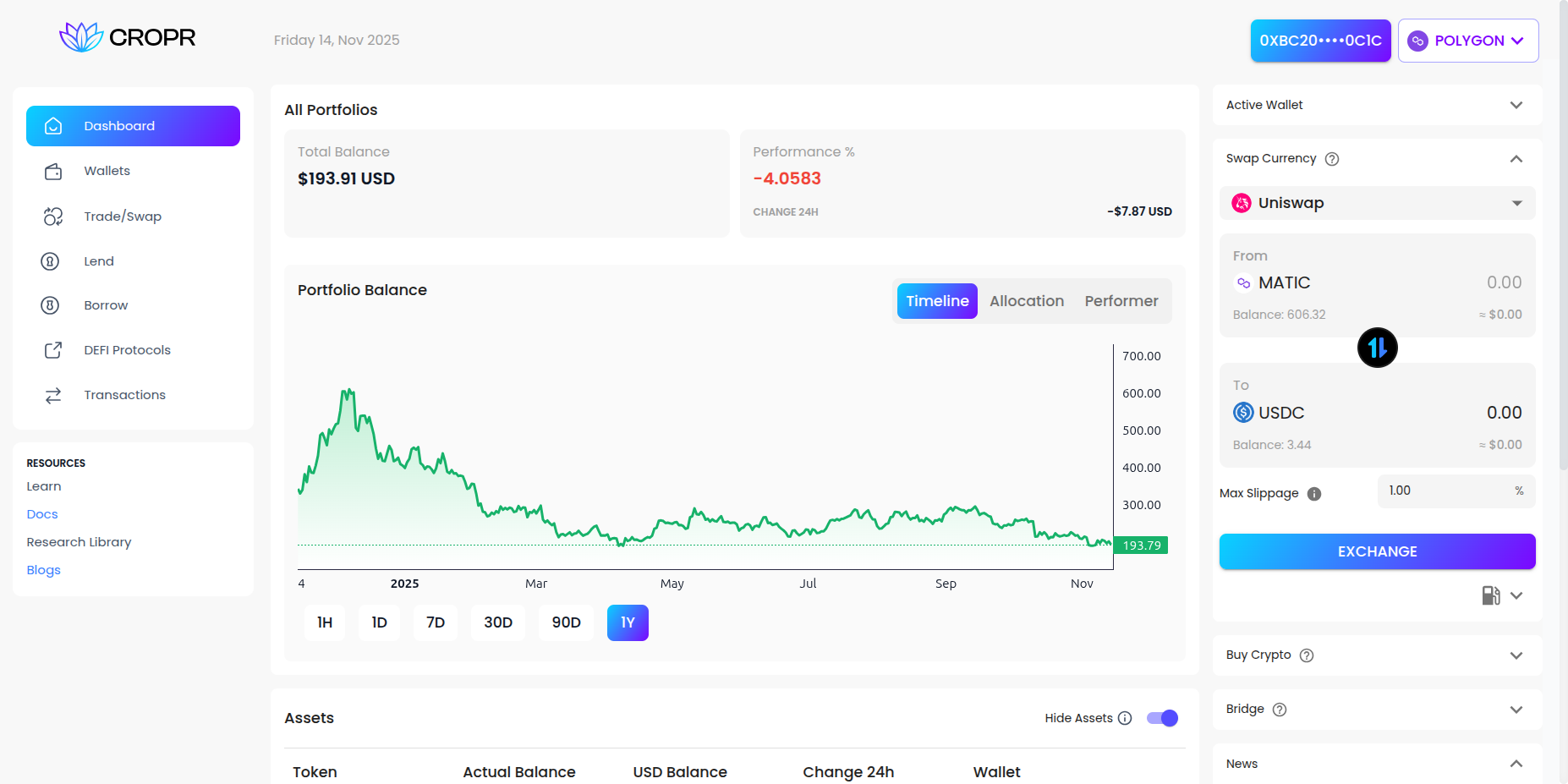

Think of CROPR as your crypto command centre. One dashboard for every wallet and blockchain you use. Trade, lend, stake, rebalance – all from a single screen. This blog explores how CROPR’s portfolio management system simplifies DeFi investing, helping you capture better yields with less effort.

Why Most Investors Struggle to Maximize Returns

Let’s be honest: holding tokens isn’t enough anymore. If you want real gains, you need to actively optimize. But that’s easier said than done.

And the data backs it up. A crypto-focused portfolio delivered 76.25% annualized returns over the past decade, compared to the S&P 500’s 11.89%.

The Common Pitfalls Holding Crypto Investors Back

- Moving assets across chains to chase better yields

- Reallocating liquidity when reward pools change

- Using lending and borrowing markets efficiently

- Keeping up with protocol risks and interest rate shifts

The Hidden Costs of Managing Crypto Without the Right Tools

Without an advanced crypto asset manager, this means:

- Opening different wallets and dashboards daily

- Comparing yields across multiple protocols manually

- Tracking historical performance in spreadsheets

- Making decisions based on incomplete or outdated information

The result? Slower reaction times, higher risk exposure, and suboptimal returns.

What to Look for in a Crypto Portfolio Manager

Not all portfolio tools are created equal. Some are glorified balance checkers. Others lock you into centralized ecosystems.

Even a small crypto allocation can make a big difference. For instance, a portfolio with just 5% Bitcoin achieved 26.33% cumulative returns versus 18.38% without crypto, while improving overall risk-adjusted performance.

CROPR delivers comprehensive crypto portfolio solutions:

- Extensive protocol and chain support – Access positions across multiple blockchains and leading DeFi protocols from a single platform.

- Self-sovereign security – Keep the assets under your control. CROPR never holds custody.

- Designed for all experience levels – Intuitive for beginners yet sophisticated enough for experienced traders.

- Profit-oriented architecture – Purpose-built for maximizing returns, not just tracking balances.

Centralized vs. Decentralized Tools: Which Drives Better Returns?

Centralized tools include portfolio features, but they limit protocol access, slow cross-chain moves, and add steps that delay decisions. That hurts returns.

A decentralized manager like CROPR gives you direct protocol access and real multi-chain flexibility.

You act faster, take fewer steps, and adapt before the market shifts.

| Feature | Centralized Tools | Decentralized (CROPR) |

| Asset custody | Platform-held | User-held |

| Protocol integrations | Limited | Direct (Uniswap, Aave, Compound, etc.) |

| Multi-chain management | Restricted | Seamless and unified |

| User control | Partial | Full |

| Flexibility across chains | Low | High |

If you value both performance and control, decentralized portfolio management is the clear choice.

CROPR’s Role in Simplifying DeFi Portfolio Management

CROPR brings scattered DeFi positions into one place, so decisions are faster and cleaner.

- Unified visibility – All your wallets, all your chains, one dashboard. No more mental gymnastics trying to remember which assets are where.

- Streamlined operations – Swap tokens, add liquidity, stake assets, manage loans. Why jump between platforms when you don’t have to?

- Current market intelligence – Live price feeds, real-time yield updates, continuous performance metrics. You’re never working with yesterday’s data.

- Reduced complexity – Fewer tabs, fewer manual trackers, and fewer copy-paste errors mean you spend less time on busywork and more time on strategy.

How CROPR Protects and Grows Your Returns

CROPR focuses on outcomes: better timing, lower costs, and fewer avoidable losses.

It gives you the edge to manage your portfolio efficiently.

It’s not about tracking what happened, it’s about staying ahead of what’s next.

Early risk detection

The platform continuously monitors your lending and liquidity positions, identifying potential losses before they occur.

That means you can prevent problems instead of reacting to them.

Real-time decisions, not guesswork

Instant alerts on key shifts in yield or utilization help you adjust before markets move too far.

You spend less time watching charts and more time acting on insight.

Efficient capital allocation

CROPR highlights where your assets are underperforming and shows where they could work harder.

You optimize capital without manually comparing pools or protocols.

Transparent performance insights

Get a clear view of profits, portfolio balance, and more in one dashboard.

You always know how your decisions impact your overall returns.

The Key to Sustainable Cryptocurrency Growth

Here’s the truth: maximizing returns takes more than holding and hoping.

You need tools that keep up with the pace of DeFi.

An advanced portfolio manager like CROPR unifies assets, automates tracking, and simplifies access to yield opportunities. By combining wallet connectivity, protocol integration, and flexible asset management, CROPR gives investors full visibility and confidence to grow sustainably.

DeFi shouldn’t feel like a full-time job, CROPR makes it manageable.

If you’re ready to simplify your crypto strategy and earn smarter, join the CROPR Beta today and experience the difference.